News report from Toyota Motor Thailand Co., Ltd. on the Thai automotive market in January 2025 reveals that the overall market sold 48,092 units, a decrease of 12.3% compared to the same period last year. The passenger car market shrank by 22%, with 18,254 units sold. The commercial vehicle market also slowed down by 5%, with 29,838 units sold, and the one-ton pickup market saw sales of 15,363 units, down by 14.4%. Regarding the xEV market (hybrid and electric vehicles), total sales amounted to 20,452 units, which accounts for 43% of the total vehicle market, reflecting a 4.63% decline. However, hybrid electric vehicles (HEVs) saw growth of 12%, with 11,441 units sold, while sales of battery electric vehicles (BEVs) totaled 7,239 units, a drop of 29.9%.

For vehicle sales volume and the top 3 market leaders in January 2025:

-

Overall Vehicle Market: 48,092 units sold, down by 12.3%.

- 1st place: Toyota, 17,379 units, down by 0.8%, market share 36.1%.

- 2nd place: Honda, 7,062 units, down by 14.9%, market share 14.7%.

- 3rd place: Isuzu, 6,137 units, down by 22.6%, market share 12.8%.

-

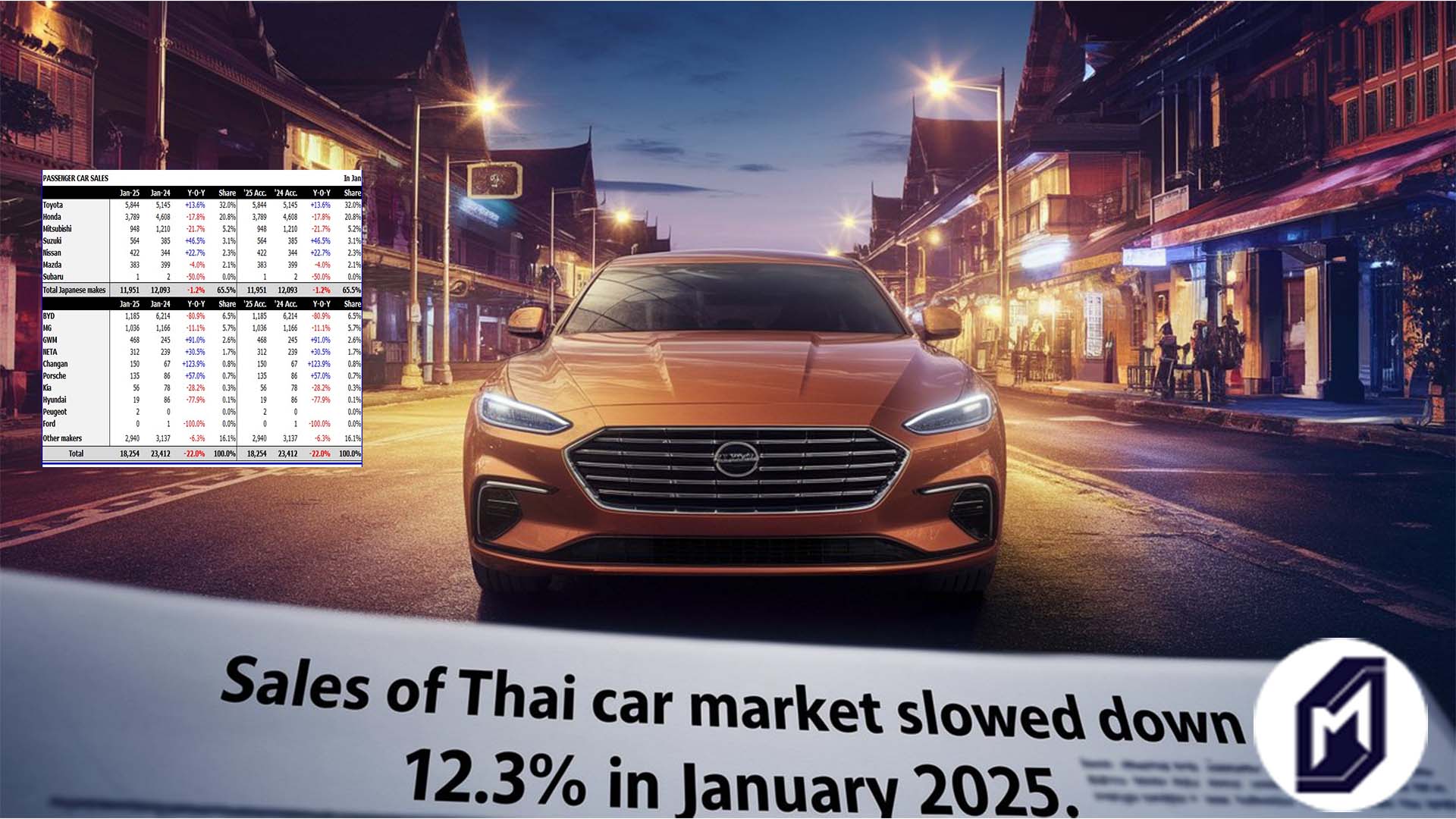

Passenger Car Market: 18,254 units sold, down by 22%.

- 1st place: Toyota, 5,844 units, up by 13.6%, market share 32%.

- 2nd place: Honda, 3,789 units, down by 17.8%, market share 20.8%.

- 3rd place: Mitsubishi, 948 units, down by 21.7%, market share 5.2%.

-

Commercial Vehicle Market: 29,838 units sold, down by 5%.

- 1st place: Toyota, 11,535 units, down by 6.8%, market share 38.7%.

- 2nd place: Isuzu, 6,137 units, down by 22.6%, market share 20.6%.

- 3rd place: Honda, 3,273 units, down by 11.3%, market share 11%.

-

One-ton Pickup Market (Pure Pickup and Modified Pickup PPV*): 15,363 units sold, down by 14.4%.

- 1st place: Toyota, 6,584 units, down by 17.3%, market share 42.9%.

- 2nd place: Isuzu, 5,498 units, down by 20.6%, market share 35.8%.

- 3rd place: Ford, 1,677 units, down by 15.4%, market share 10.9%.

- Modified Pickup Sales: 3,102 units (Toyota: 1,068, Isuzu: 1,109, Ford: 704, Mitsubishi: 178, Nissan: 43).

-

Pure Pickup Market: 12,261 units sold, down by 17.5%.

- 1st place: Toyota, 5,516 units, down by 19.4%, market share 45%.

- 2nd place: Isuzu, 4,389 units, down by 25.6%, market share 35.8%.

- 3rd place: Mitsubishi, 982 units, up by 89.9%, market share 8%.

Electric Vehicle Market Update:

The electric vehicle market has entered a period of adjustment, with BEV sales in January 2025 totaling 7,239 units, down by 29.9%. Among the new electric vehicle brands, BYD led the market with 1,185 units sold, a decrease of 80.9%. Neta sold 312 units, an increase of 30.5%, while Changan sold 150 units, up by 123.9%.

Outlook for February 2025:

Mr. Supakorn Rattanaworaha, Executive Vice President of Toyota Motor Thailand, shared that the automotive market in February is expected to remain stable or decline slightly compared to February of the previous year, reflecting the current economic conditions. Financial institutions may remain concerned about the high household debt and consumers' ability to repay, which could affect lending policies. However, the recent reduction of the Bank of Thailand's policy interest rate from 2.25% to 2.00% per year, effective immediately, may help alleviate the public's burden and stimulate the economy, potentially influencing consumer purchasing decisions. Nonetheless, the automotive industry will still require time to recover alongside the broader economic recovery.

End-of-Year 2024 Vehicle Orders:

In the Thailand International Motor Expo 2024 (41st edition) held from November 28 to December 10, 2024, a total of 54,634 vehicles were ordered. Of these, 32,070 units (58.7%) were internal combustion engine (ICE), hybrid electric vehicles (HEV), or plug-in hybrid electric vehicles (PHEV), while 22,564 units (41.3%) were 100% electric vehicles (BEV).

The brand breakdown of vehicle orders is as follows:

- Toyota: 8,297 units

- BYD: 7,042 units

- Honda: 5,081 units

- Aion: 3,668 units

- MG: 3,311 units

- Deepal: 2,756 units

- Mitsubishi: 2,609 units

- Nissan: 2,219 units

- GWM: 2,060 units

- Neta: 2,016 units

- ISUZU 1,942 units

- MAZDA 1,509 units

- BMW 1,331 units

- FORD 1,154 units

- Mercedes-BENZ 1,122 units

- SUZUKI 1,012 units

- OMODA & JAECOO 1,008 units

- ZEEKR 866 units

- GEELY 766 units

- XPENG 638 units

- DENZA 573 units

- HYUNDAI 555 units

- RIDDARA 532 units

- KIA 468 units

- WULING 389 units

- AVATR 337 units

- VOLVO 330 units

- MINI 230 units

- TESLA 193 units

- AUDI 141 units

- LEAPMOTOR 117 units

- LEXUS 99 units

- PORSCHE 92 units

- JUNEYAO 63 units

- PEUGEOT 22 units

- LOTUS 20 units

- MASERATI 15 units

- JEEP 11 units

It is noted that these vehicle orders should reflect in the registration figures within 1-2 months, mainly in December 2024 and January 2025. It is commonly known that consumers who purchase vehicles at such exhibitions prefer to register them in January to receive a new registration year for their vehicles. The volume of vehicle registrations from these exhibitions will have a significant impact on the sales volume reflected in future reports.