Despite the decline in profits, Toyota expects to increase its dividend for fiscal year 2026 to ¥95 per share—up ¥5 from the previous year.

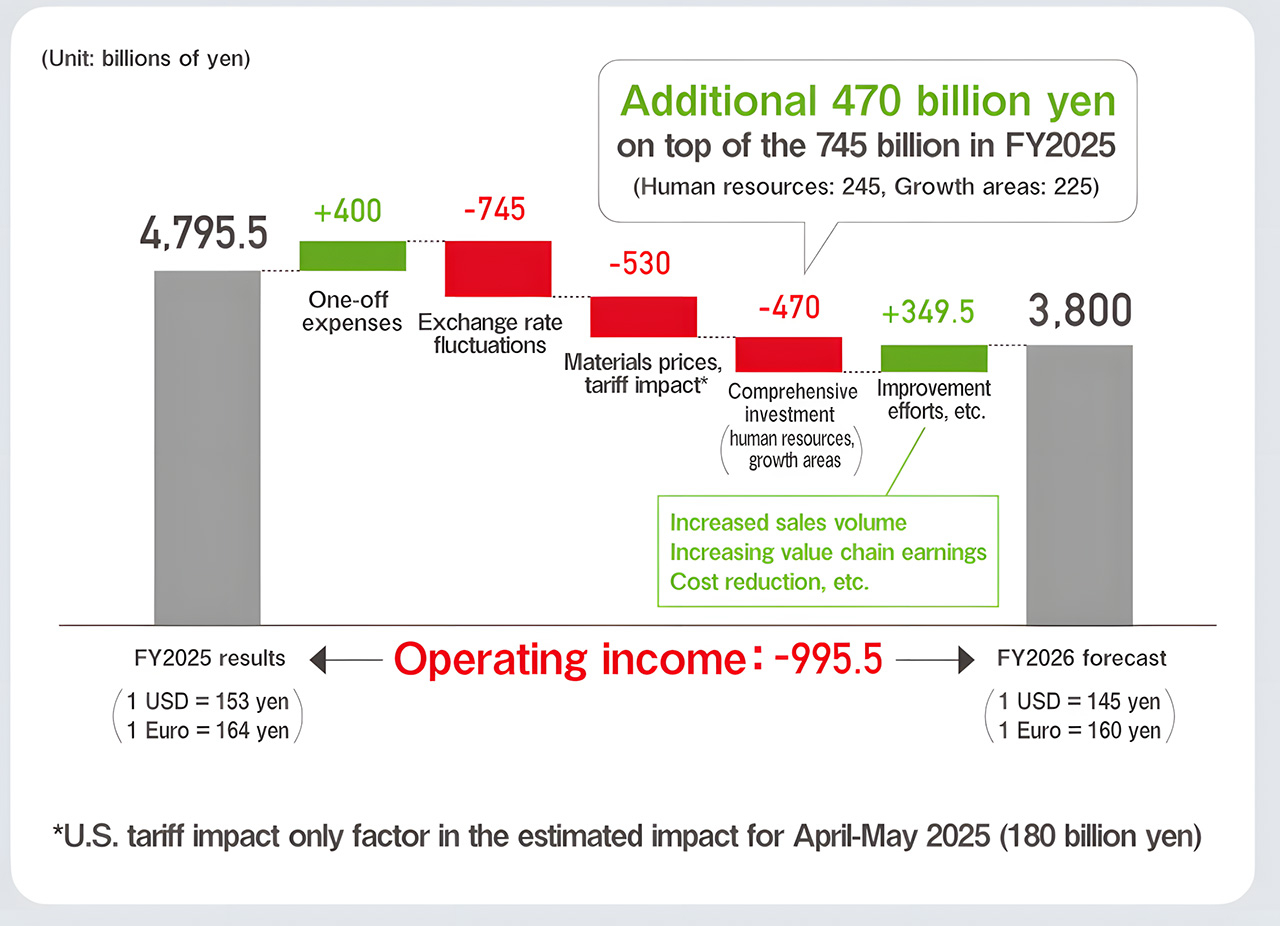

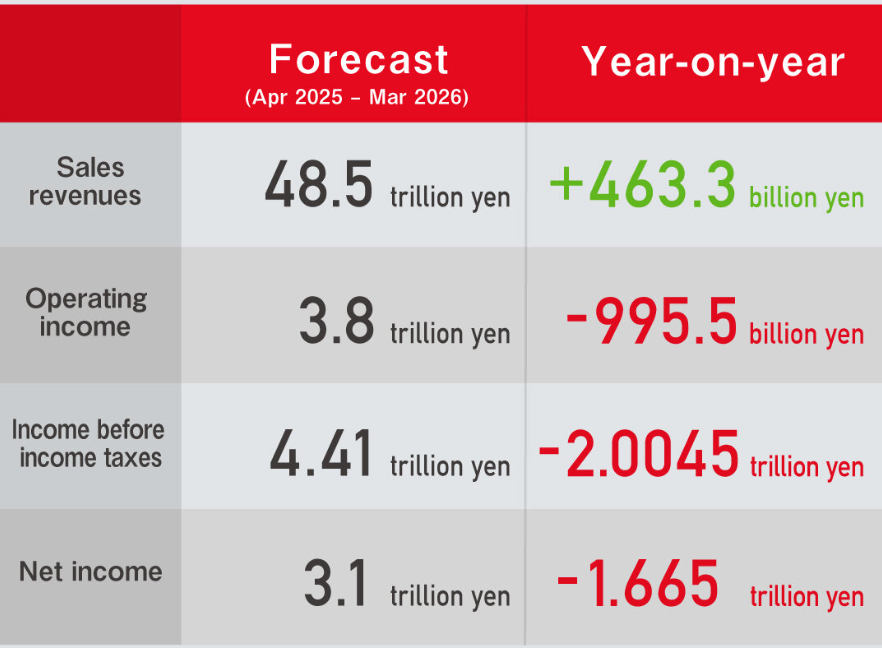

Toyota has projected its financial performance for the fiscal year 2026, estimating operating income at ¥3.8 trillion—a decrease of ¥1 trillion from the previous year—and net profit at approximately ¥3.1 trillion, down by around ¥1.6 trillion. The company plans to produce a total of 10 million vehicles under the Toyota and Lexus brands and targets global sales of 10.4 million units. Toyota also aims to raise its annual dividend by ¥5 per share.

According to the report, the most significant impact comes from U.S. tariff measures. Toyota estimates that in just the first two months (April–May), the tariffs will cost the company around ¥180 billion. Furthermore, foreign exchange volatility throughout the fiscal year is expected to result in losses of approximately ¥745 billion (around 170 billion baht). The rising cost of parts affected by the tariffs is another key factor, with projected losses of about ¥530 billion. Uncertainty surrounding Trump-era tariff policies and their effects on global trade have heavily impacted the U.S. dollar. A weaker dollar compared to the yen means that profits decrease when U.S. revenue is converted back to Japan.