In its financial report for the fiscal year 2025, Toyota demonstrated strong performance with operating income of ¥4.8 trillion. Despite a decline in overall profits, the company increased its annual dividend by ¥15. Strategically, Toyota has been investing in battery electric vehicles (BEVs), including establishing a wholly owned subsidiary in Shanghai to produce Lexus BEVs and batteries by 2027. Additionally, the company is accelerating its transition into a full-scale mobility provider through investments in new infrastructure such as test tracks and by leveraging its global fleet of over 150 million vehicles to expand its services and technologies.

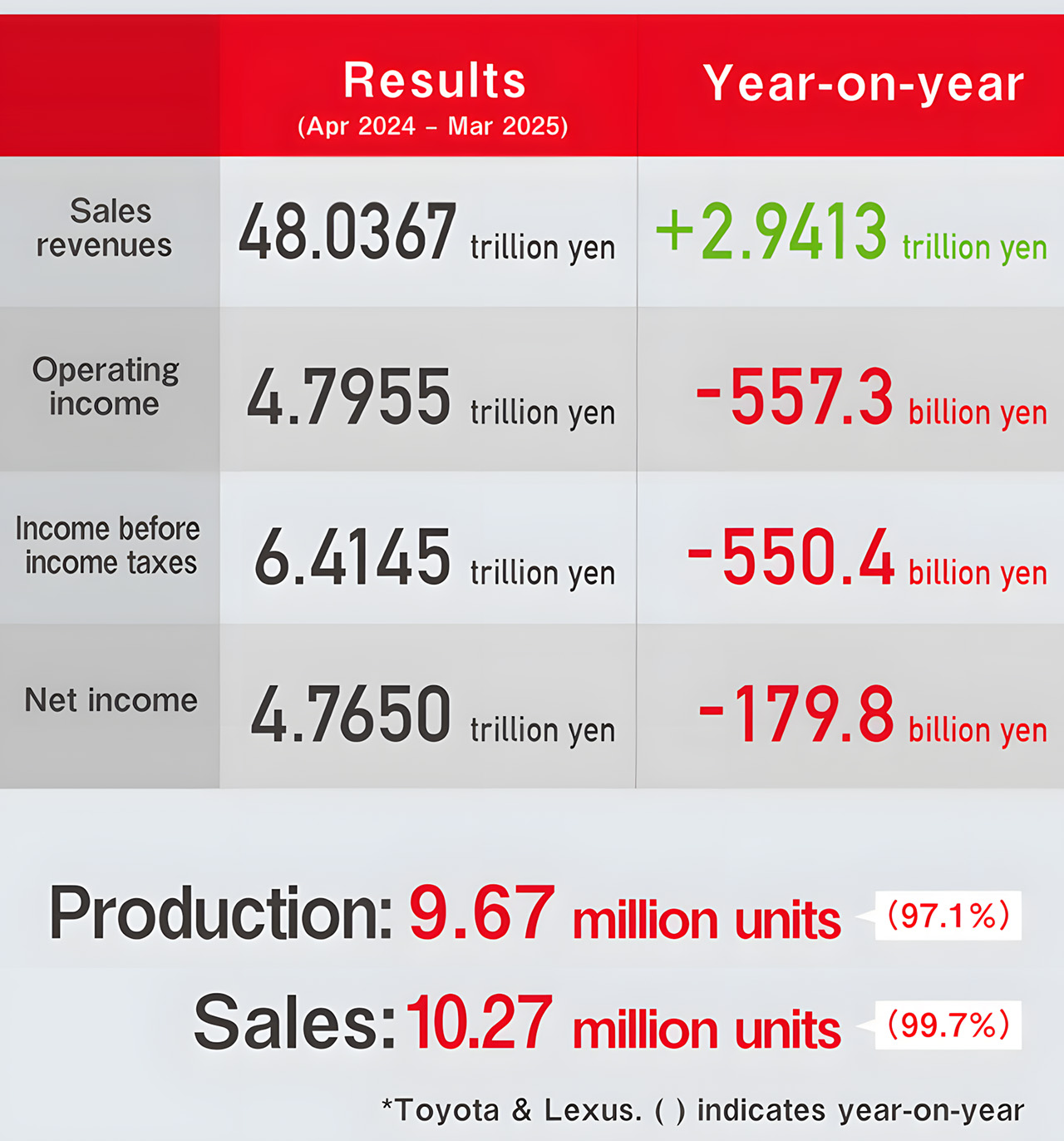

Summary of Fiscal Year 2025 Financial Results

-

Operating income: ¥4.8 trillion

-

Net profit: ¥4.765 trillion

-

Total revenue: ¥48 trillion

-

Vehicle sales: 10.27 million units

-

Dividend: Increased by ¥15

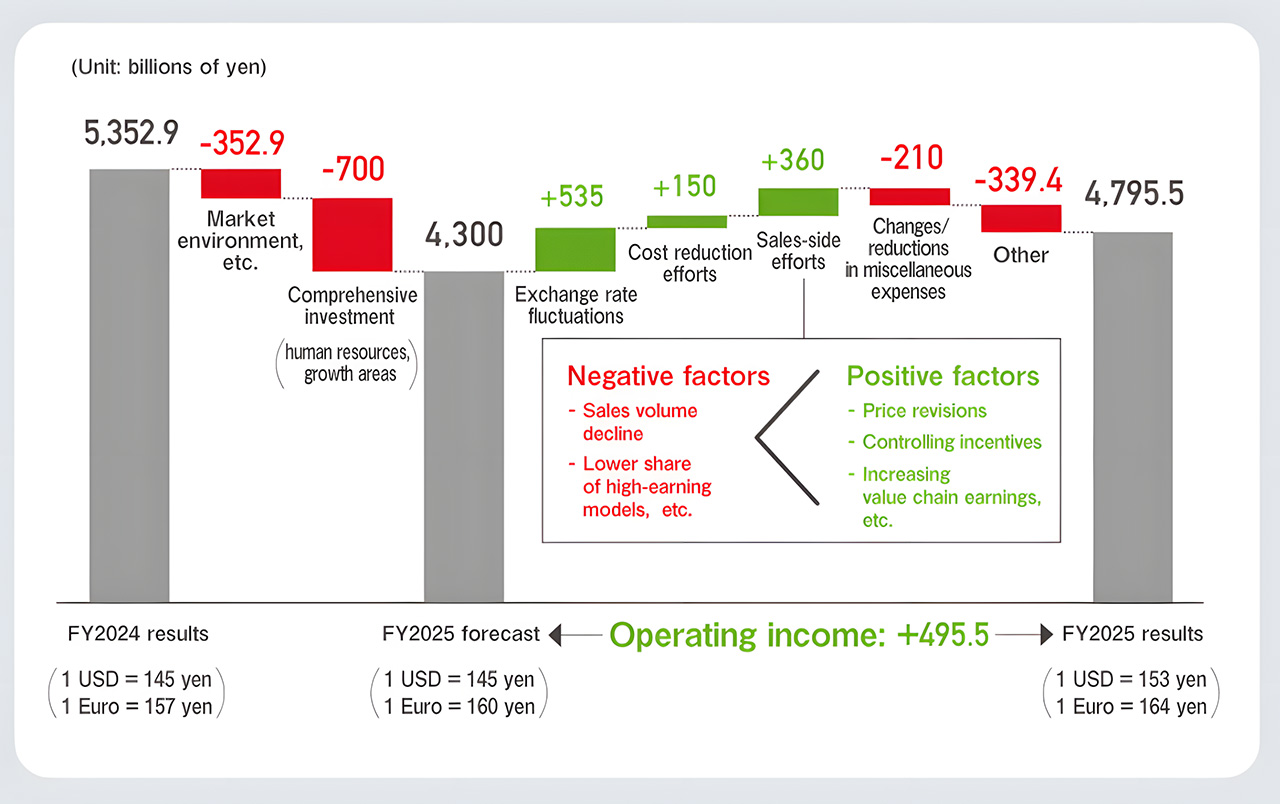

Compared to previous forecasts for fiscal year 2025, the actual operating income reached ¥495 billion, which exceeded expectations. Several factors influenced this outcome, including a decline in sales of high-profit models. However, Toyota continued to benefit from its ongoing efforts in cost reduction, favorable foreign exchange rates, and increased income from value chain expansion — all of which contributed to strengthening the company’s overall performance.

The value chain refers to business activities focused on the existing vehicle fleet, which are less affected by fluctuations in new vehicle sales. These include:

-

Vehicle maintenance

-

Sales of accessories and spare parts

-

Used car sales

-

Accident insurance and financial services

The value chain business is experiencing rapid growth, expanding at a rate of ¥150 billion per year. Toyota plans to scale this segment to exceed ¥2 trillion in the fiscal year 2026.